How AI Transforms the KYC Process in Banking and Insurance

The banking and insurance industries face increasing pressure to streamline processes, enhance customer experiences, and mitigate compliance risks. One area undergoing significant transformation is the Know Your Customer (KYC) process. Artificial Intelligence (AI) is emerging as a game-changer, revolutionizing how institutions verify customer identities, monitor transactions, and ensure regulatory compliance.

Challenges in the Traditional KYC Process

Traditional KYC processes often involve manual document verification, cross-referencing data, and extensive paperwork. These methods are:

- Time-Consuming: Lengthy approval timelines frustrate customers and reduce operational efficiency.

- Costly: Manual processes incur high operational expenses.

- Error-Prone: Human oversight can lead to inaccuracies and missed red flags.

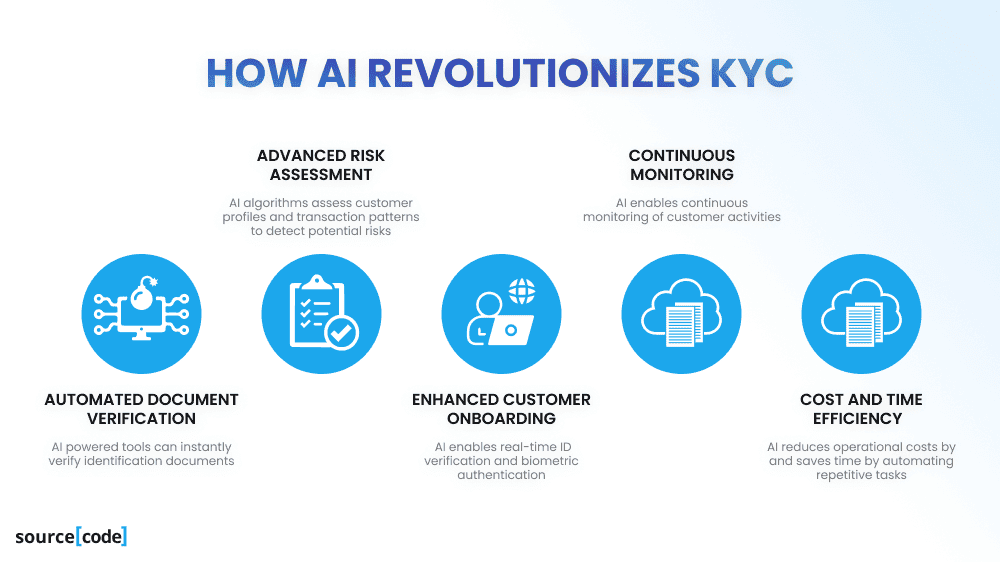

How AI Revolutionizes KYC

AI brings automation, accuracy, and efficiency to KYC processes. Here’s how:

- Automated Document Verification

AI-powered tools can instantly scan and verify identification documents like passports or driver’s licenses. Using Optical Character Recognition (OCR) and Natural Language Processing (NLP), these tools extract, analyze, and authenticate data in real time. - Advanced Risk Assessment

AI algorithms assess customer profiles and transaction patterns to detect potential risks. By analyzing vast amounts of historical data, AI identifies anomalies and flags suspicious activities with unparalleled precision. - Enhanced Customer Onboarding

AI accelerates customer onboarding by enabling real-time ID verification and biometric authentication, offering a seamless customer experience. Chatbots and virtual assistants further improve interaction by guiding users through the process. - Continuous Monitoring

Unlike traditional KYC, which often involves periodic reviews, AI enables continuous monitoring of customer activities. Machine learning models adapt over time, becoming more adept at identifying emerging risks. - Cost and Time Efficiency

AI reduces operational costs by automating repetitive tasks. Institutions save time and resources while enhancing compliance standards.

Real-World Applications in Banking and Insurance

- Banking: AI-driven KYC solutions streamline account opening, enable fraud detection, and ensure compliance with Anti-Money Laundering (AML)

- Insurance: AI simplifies policy issuance, claim processing, and customer verification, minimizing fraud and improving customer trust.

The Future of AI in KYC

As regulatory requirements evolve, AI’s role in KYC processes will only grow. By integrating blockchain for immutable records and leveraging AI for predictive analytics, banks and insurers can stay ahead of compliance challenges while fostering trust and efficiency.

Takeaway

The adoption of AI in the KYC process is no longer optional; it’s a necessity for institutions striving for agility, compliance, and customer-centricity. Embracing AI-powered solutions not only mitigates risks but also drives innovation and competitive advantage.

#ArtificialIntelligence #KYC #BankingInnovation #InsurTech #Compliance #DigitalTransformation